International Women’s Day 2022: Mind the Gender Insurance Gap

Just in time for International Women’s Day 2022, we are taking a look behind the scenes: How well are women covered?

Insurance is not necessarily the first thing that comes to mind when talking about equality between men and women. Yet the genders haven’t even been legally equal in the German insurance sector for ten years. More to the point: Only since 2012, a person’s gender can’t be used as a criterion to determine pricing anymore – a promise of equality for men and women. Nevertheless, women still own fewer insurance policies than men and the gender insurance gap prevails. But there is a ray of hope: Our data analyses from the years 2020 and 2021 have shown that the gap is closing.

Gender Insurance Gap: Baby Steps?

Of all our customers today, 40 % are women. This is a 3 % increase in comparison to last year. In the under-25 age group, still 46 % of customers are female – thus showing that the gender insurance gap is primarily being closed by the younger generations, i.e. millennials and Gen Z.

While women still are co-insured more frequently than men, the difference between genders has decreased significantly. Since last year, out of all co-insured customers, 52 % have been female and 48 % male.

Interestingly enough, only one of our products is bought more often by women than men: dog liability insurance. Of all our dog liability customers, 57 % are women. At the same time, other insurance products such as legal insurance are still largely purchased by men. In our analysis in 2020, men were twice as likely to take out legal insurance as women. That number has remained the same to date (67 %).

Another trend continues: Women are still much less likely to cause or report claims. Only about 40 % of all claims that were filed in 2021 came from female customers. This shows that, ultimately, women are less insured than men even though they cause fewer damages.

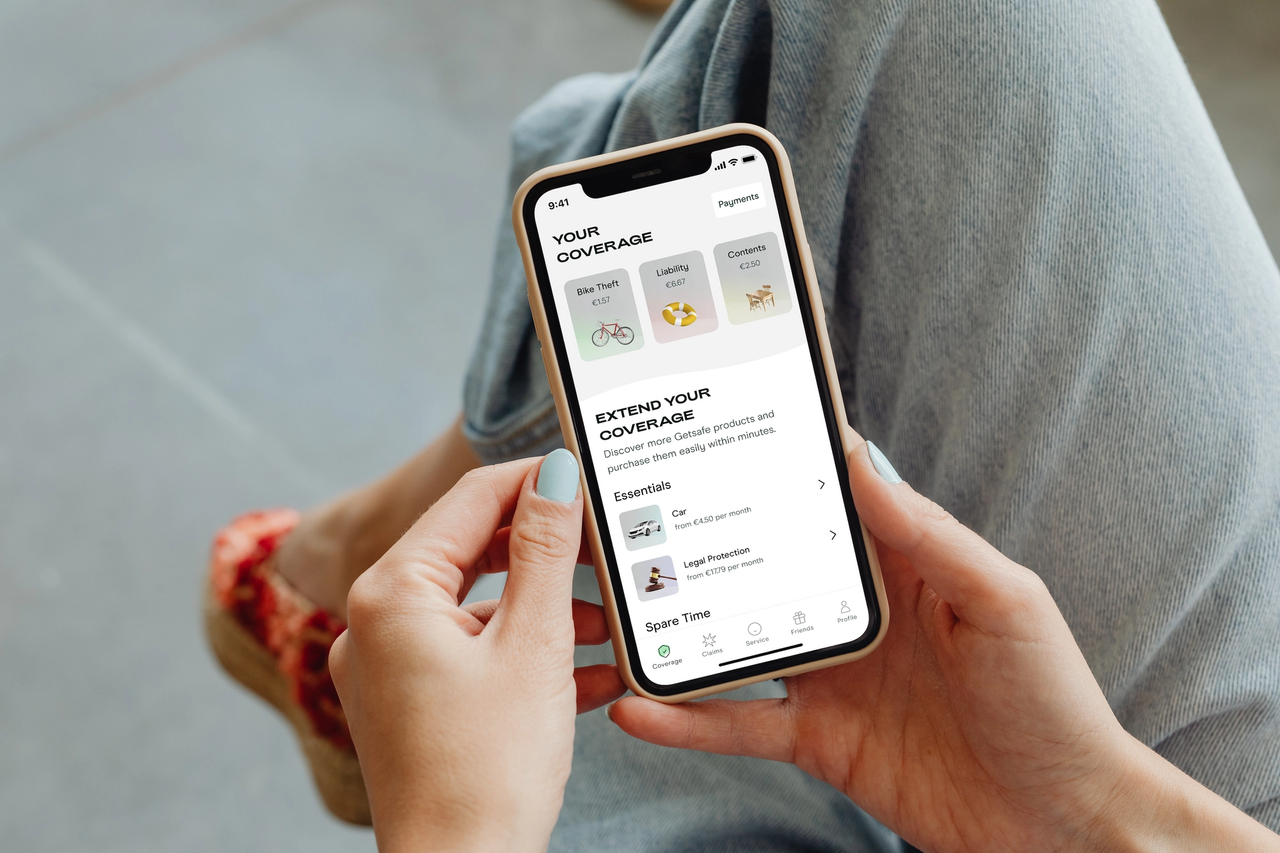

Our approach – mobile insurance is fair insurance

Of course, it takes some effort to tackle your own finances and sort out your insurance situation. Yet, there’s a lot to be done on the supply side as well: This is where Getsafe swoops in. We seek to make insurance accessible, transparent and fair. Thanks to our digital-first approach, we give young people an opportunity to understand their insurance needs and get covered easily. The Getsafe app serves as a simple source of information and a place where they can buy, manage and adapt their policies according to their needs – and keep them handy wherever they go.

You can get more information about how the gender insurance gap has developed and what Getsafe is doing to put a stop to it in our blog article on International Women’s Day 2020.

The fight for equality isn’t over yet – especially with regards to financial coverage. But the data is showing a positive trend: Women are increasingly taking charge of their finances and facing the gender insurance gap head-on.

You might also like: