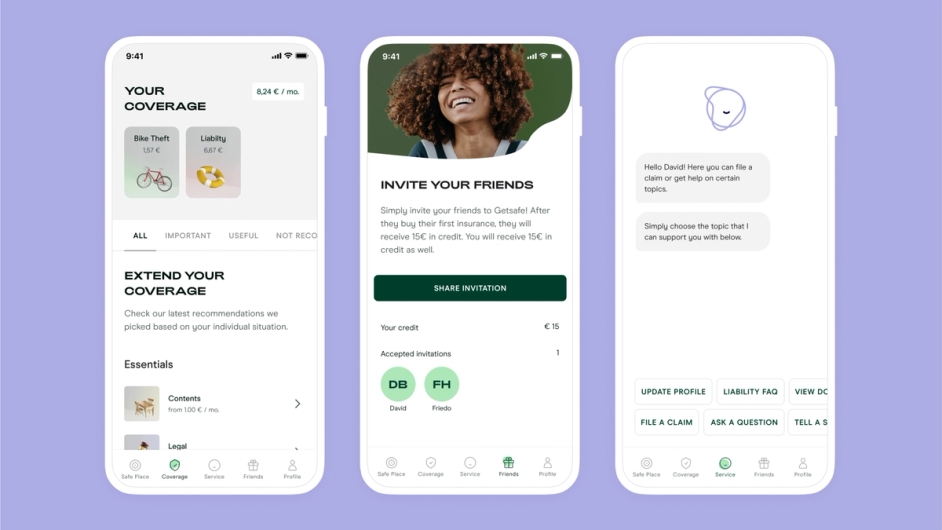

The New Getsafe – For a New Generation of Insurance Customers

A new logo, a new design, a new voice: learn more about Getsafe's new brand from founder and CEO Christian

Since our foundation in 2015, Getsafe has grown up a lot, but mostly underneath the surface. We have become Germany’s most-sold insurance brand among millennials with a strong app. Now it is time to open a whole new chapter: with a new logo, a new design and a new voice that truly live up to our vision. We empower people to live life to the fullest by covering them and their universe, no matter who and where they are.

Redefining ourselves

For Getsafe, the past year was defined by growth. What began with a team of 40 and two products ended with a 90-person team, six products and two markets.

Those were the external signs of change. But inside, too, much was changing. Over the past twelve months, we have put a lot of thought into who we are, who we want to be for our members, and how we differentiate ourselves from the rest of the industry.

We came up with several answers. We see ourselves as a tech company doing insurance and not the other way around. We radically pursue a mobile-first approach. Our products are easy to use, easy to understand and flexible. And we think big and are not satisfied with a niche existence, but rather challenge the world's largest insurers by building a full stack, multi-line offering in multiple countries.

Every risk holds an opportunity

All this is true, but it only reflects bits and pieces of what we believe in. And so we kept on thinking and looked for further answers. And we realised that we approach insurance from a very different angle than other insurance companies do. When we think about insurance, we think about empowerment. Why? Allow me to explain.

Every life decision involves risks. Be it quitting your current job, starting a company, traveling to an exotic country or tackling that difficult slope with your skis: every decision is about taking those risks and seeking opportunities to live better.

While arguing for one direction or another, having a safety net is an enabler and a privilege – and insurance plays an essential role in our safety net. Opt in, opt out, switch it, change it, make it yours. That is how today’s insurance should be. It’s about flexibility, a positive experience, a new understanding of needs and habits.

What’s more? By using technology, insurance has the power to unlock a level of empowerment we’ve never seen before. What if there was a way to prevent risks from happening, supporting you to take big or everyday life decisions more wisely? Life will still be all about taking risks, but insurance companies could support you in taking the right ones.

Empowerment as our guiding principle

In everyday life, we often experience that insurance companies have a bad reputation. Many companies advertise with fear and horror scenarios; many customers have unpleasant memories of cumbersome contract clauses and lengthy processes.

But an insurance company is more than just a backup solution. It allows us to take risks that we might otherwise shy away from. It lets us get past the mishaps in everyday life with a confident smile and a shrug of the shoulders. And it softens the blow when life presents us with more difficult situations. When we think about insurance, we see it as a privilege, a safety net, something that allows us to live in a carefree and light-hearted manner and that cushions our worst days in a spirit of solidarity.

Our new brand reflects this concept: life happens. We cannot protect you from all risks and worries. But we can make sure that even in the event of a mishap you can look forward, stay positive and don't get held back. You spilled coffee on the keyboard? C'est la vie! A burst pipe at home? No tears needed. A stolen bicycle? Annoying, but we’ve got you covered. Stuff breaks, but it’ll never break you!

We aim to change insurance so that people see it as their life companion and supporter – not an annoying, necessary task you have to go through when you have a claim. It’s not about using the safety net, it’s about living in the knowledge that it’s there for you anytime you need it.